APPRAISAL SERVICES

APPRAISALS

Using my services as a member of The International Society of Appraisers ISA & accredited by the Uniform Standard of Professional Appraisal Practices USPAP will give you the highest level of appraisal.

ESTATE APPRIASALS

You have spent a lifetime collecting. Consider your collection as important as any financial records in your portfolio. High end collectibles are bringing record prices. Potentially you want to leave a financial path so that your descendants are not left in the dark. I see this all the time.

CONSULTING

You may have inherited or given a collection but do not know its value. Or, you may have a collection that you want to sell or auction, or know where the best place is to liquidate it.I am also available for deposition or trial.

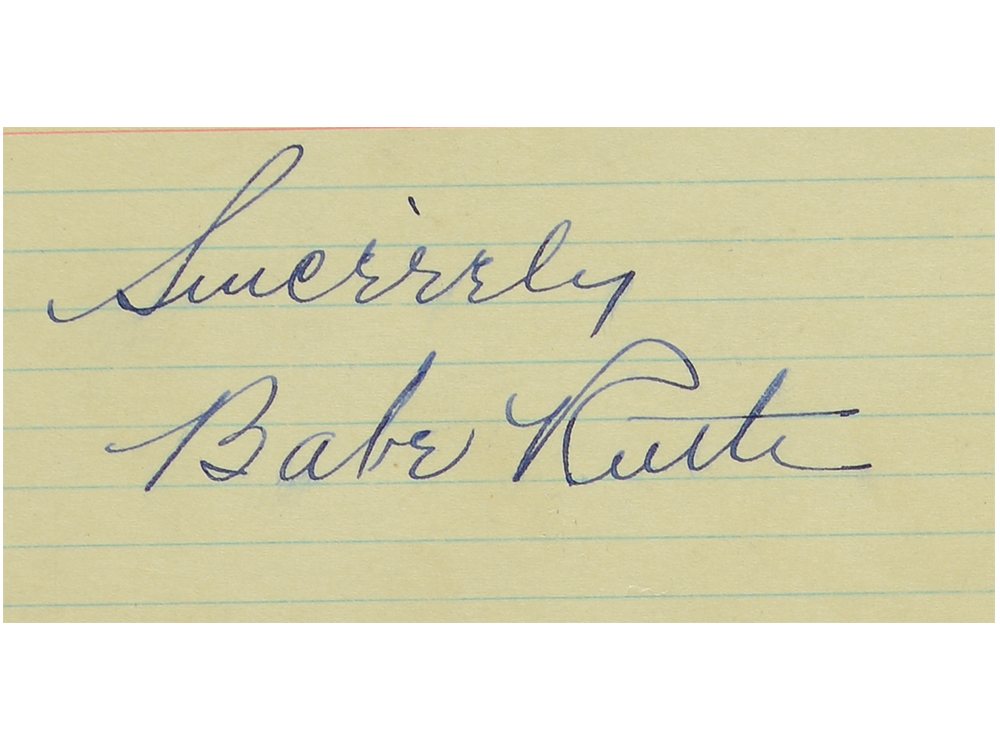

AUCTION

You may be interested in testing the collectible market through auction, which is currently the most popular form of selling. This may be the best path especially for one-of-a-kind memorabilia. I can give you an overview of the current market for your collectibles – timing is everything. There are a lot of auction choices out there. I can guide you to the best option for your specific collection. The biggest auction companies are not always the best outlet! You want to work with a company that has a database of customers that caters to your specific collectibles. As someone who ran his own auction house and has worked for & worked with other auction houses, I can guide you through the tedious issues of seller’s fees, authentication fees, photography & grading fees and explain buyer’s premiums - most of what the common public is completely unaware & surprised. Reading those small print contracts are intimidating and frightening to the common person. I will guide you through that process!

DONATIONS

There are collections that you might like to donate to a museum or institution. Donation appraisals can be tax deductible and are commonly prepared by your CPA and issued to the IRS. I can guide you through the process and explain the paperwork involved.

DIVORCE SETTLEMENTS

My appraisal & credentials will be the best result for both parties to get an impartial appraisal especially during a contentious divorce. I am also available for deposition & trial.

INSURANCE CLAIMS

Evaluating collectibles that have been damaged by water, fire or otherwise.

SPEAKER

Do you need a speaker for your group to explain appraisals, how you can benefit from them and answer questions?

ESTATE PLANNING

With some careful consideration, we can have some control over the aftermath of our death. Carefully crafting an estate plan for your worldly possessions not only shares your desires and wishes with those you leave behind but also eases some of the burdens for them. A complete appraisal estate plan services your entire estate—all your possessions and assets. Your collection is just one piece of the puzzle. You’ve spent a lifetime building up a collection you cherish, it’s time to properly protect and preserve those assets. Your collection isn’t necessarily driven by value or quantity. It’s when the collection becomes important to you, that’s when you create an estate plan for your art collection.” The time when the it "becomes important to you" can be a variety of things and is ultimately a personal choice. It can be at a particular value point of the collection, a certain amount of time you spent acquiring it, or a time when you have a strong sentimental attachment to the works. Once you deem your collection important enough to plan for, it's time to start the process.

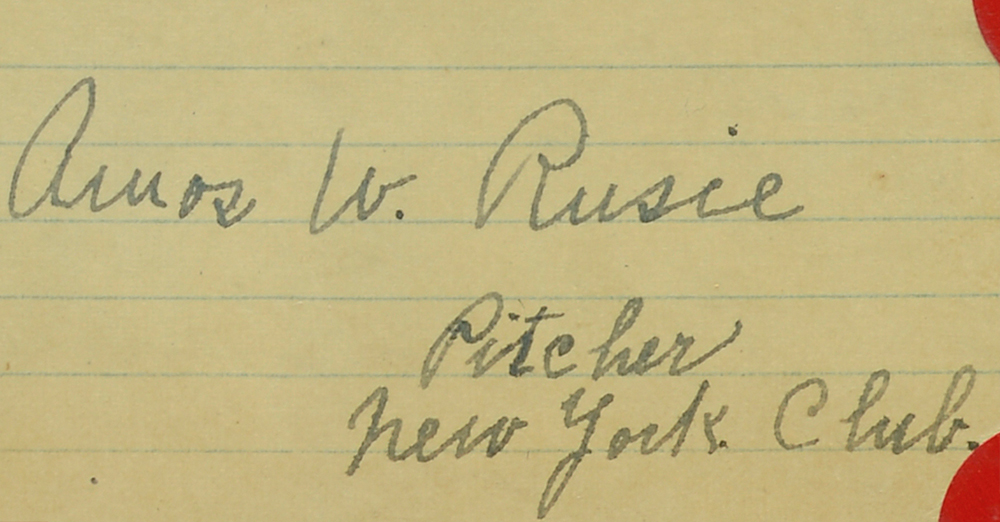

Inventory Your Collection

Before you can bequeath anything, from a single item to a large collection, you have to know what you have. Your inventory should include important identifiable information about each piece in your collection. This can consist of pictures, serial number or identifying number, provenance, bill of sale, invoice, appraisal reports, and any other documentation you have. Your inventory records are an important tool for those responsible for your estate after your death. It provides them with all the information about your individual pieces and your collection as a whole. Using my appraisal system to manage your collection and important documents not only keeps your information secure in one place, it also makes it easy for others to access during and after the estate planning process. Your attorney most likely won’t be an art aficionado. Ford says, “ the difficult thing to understand about collectibles is the value, whether that be fair market, insurance, and what we will place on it as a taxable estate.” To understand the value of the pieces in your collection, keep accurate and up-to-date appraisals of each piece. This value will be the basis of any taxes that go along with your collection after your death.

Consider Tax Burden

It’s important to consider the tax burden your collection will bring along to its inheritor whether that be a gift, estate and/or income taxes on the works you leave behind. Estate taxes are different in every state, so check with your legal team for an accurate estimate for your collection. If you have a collectible that will highly appreciate over time, you can consider giving the it away during your life before it doubles in value so that any appreciation is not included in the estate. You can also consider a life estate, making a gift now but maintaining the right to use it for the remainder of your lifetime.

Determine Who Gets Your Collection

There are a few ways to plan for your collection after your death. You can leave an individual piece or the entire collection to one person or group. You can donate the works to a charity, museum or institution.

Ensure That Your Wishes Are Actually Executed

Whether your estate plan lists keeping the works in the family or bequeathing them to an institution, even the most comprehensive estate plan is just a list of your wishes. You have to rely on the executor of your estate and your family to abide by the plan. Save yourself from making estate planning an even bigger endeavor than it already is, and start archiving your collection now.

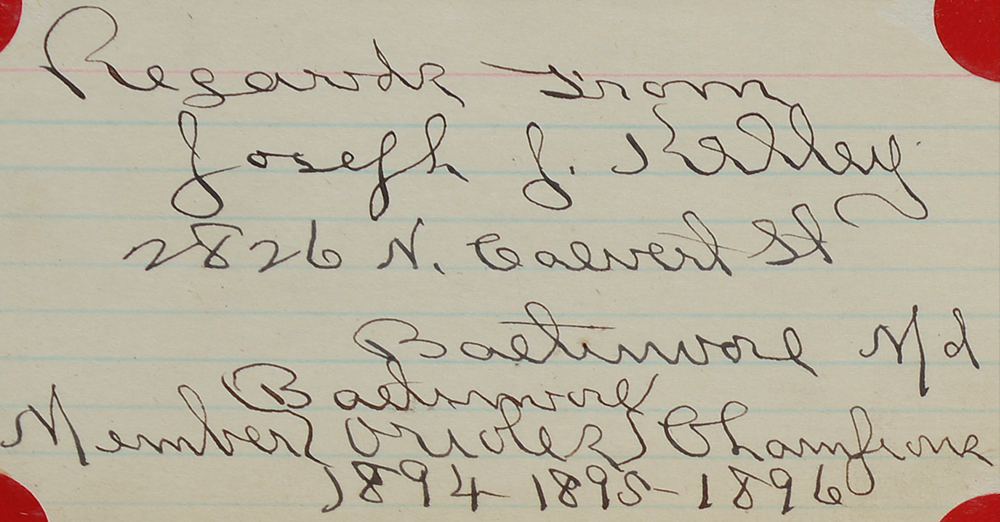

PROBATE

Probate is the legal process for administering and distributing an individual's estate after death. Appraising the deceased person's property is an important part of this process for several reasons, such as figuring out whether the estate is subject to estate tax and determining how to fairly divide assets among the estate's beneficiaries according to the deceased person's will or state laws.